Don’t be penny-wise and pound-foolish!

Arco360 have been selected as one of our 20 brands of 2020, for their six years of service in the equestrian industry, ‘insuring animal vitality’.

Who is Arco360?

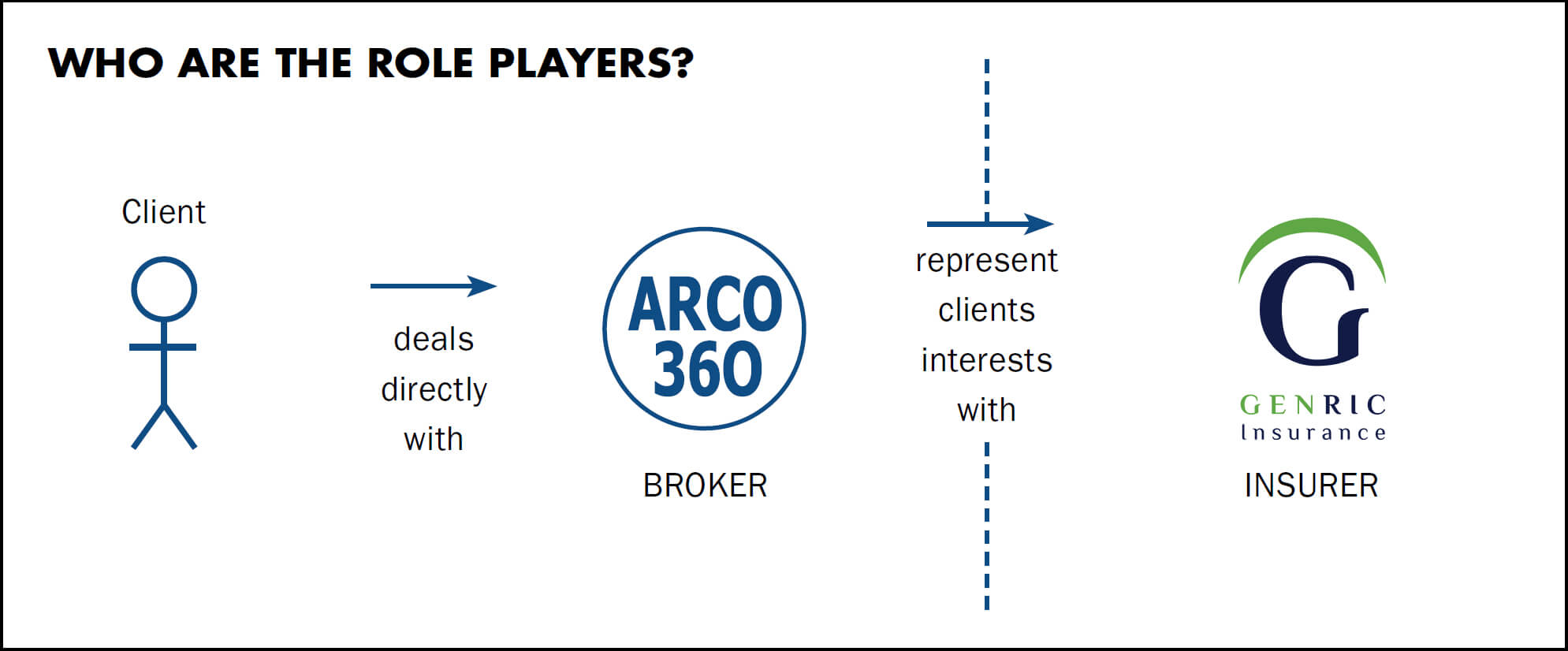

Arco360 is an insurance broker specialising in equine and pet products. The team always strives to provide a personal and professional service with unmatched passion. Back in 2014, Gen McNeill and Candice Hobday partnered to establish the brokerage, bringing together a wealth of equestrian experience and equine insurance background and knowledge, to evolve the company into a frontrunner in its field. With an ethos of being committed to their clients, Arco360 has been and remains extremely invested in the industry as well as in the welfare of all our four-legged friends. Arco360 is proud to be powered by GENRIC Insurance Company.

Who is GENRIC?

GENRIC Insurance Company is a market leader focussed on bringing innovative and niche insurance solutions to the market by partnering with specialist underwriting management agencies (UMAs), start-up businesses, insure-tech innovators and brokers. They strive to innovate with their business models by working with specialist partners who bring unique insurance solutions to the market, that solve pressing risk challenges.

“Unless you can afford to carry your own risk, insurance Is a must-have when owning anything of value.”

What is the History of Insurance?

Insurance has been described in history right back to the times of the ancient world of the Babylonians and Chinese Traders, some 3,000 years ago. Merchants would divide their goods between all the ships when travelling over treacherous waters, to limit their losses (embodying the proverbial ‘not having all your eggs in one basket’). Modern insurance, however, can instead be traced back to London and the Great Fire of 1666. Nicholas Barbon was the creator of the first fire insurance company, which later morphed into an accident cover company. From meagre beginnings, the insurance industry has both flourished and suffered, but always developed in parallel with civilisation and its needs.

Insurance has been described in history right back to the times of the ancient world of the Babylonians and Chinese Traders, some 3,000 years ago. Merchants would divide their goods between all the ships when travelling over treacherous waters, to limit their losses (embodying the proverbial ‘not having all your eggs in one basket’). Modern insurance, however, can instead be traced back to London and the Great Fire of 1666. Nicholas Barbon was the creator of the first fire insurance company, which later morphed into an accident cover company. From meagre beginnings, the insurance industry has both flourished and suffered, but always developed in parallel with civilisation and its needs.

Emanuel with Arco360 insured horses.

Why Insurance?

When a person has expenses, they use a budget to allocate funds to cover all those known costs. The unknown expenses, like colic or injury to your horse, cannot be budgeted for, unless you have insurance, as your premium is a known cost. Insurance is, in principle, risk mitigation: taking your potential risks and reducing the severity of the financial implications of those risks are by chance realised.

The Policies

Mortality Insurance

Equine mortality insurance only offers mortality or death cover, which is insurance that would pay out the commercial value of your insured horse in the case of an unforeseen and unexpected death or humane euthanasia (only). It does not extend to death due to old age, and therefore this cover would lapse at a certain age. The commercial value of the horse may increase or decrease during cover, depending on the training, competitive success, age and soundness of the insured horse.

Hospital Insurance

Hospital cover is governed by the four golden rules, and each claim should be qualified by all four criteria:

- Life-saving Without the surgery or treatment, the horse will die.

- Emergency Without the surgery or treatment, the horse will die today.

- In hospital The horse must be admitted to a registered facility (dispensation can be obtained in exceptional cases, for example with African Horse Sickness, where the horse is not permitted to be moved).

- Independent event The limit of the product applies to each independent event, not per diagnosis.

Euthanasia

Humane euthanasia Euthanasia is only considered humane if death is imminent, the horse’s welfare compromised through suffering and no plausible treatment options are available, or the horse has become an immediate and indefinite risk to the handler. Only a registered veterinarian who has observed the insured horse in person can certify the circumstances that qualify for this. Economic euthanasia Euthanasia is considered to be economic if the decision to euthanise is made for financial reasons only.

[tlt_layout layout=”50×50″]

[tlt_layout_column]

MedAid Cover

MedAid cover includes hospital cover, but in addition to this, has scope to cover the other issues not governed by the four golden rules mentioned earlier. Don’t be confused between medical insurance and medical aid. Medical insurance has been designed to protect the insured from unforeseen and unexpected events. This makes it bit like car insurance; not a service plan or a warranty. It is governed by entirely different legislation to medical aids and does not include a savings option.

[/tlt_layout_column]

[tlt_layout_column]

Surgery for colic would generally be covered under hospital insurance.

[/tlt_layout_column]

[/tlt_layout]

MedAid extends to issues that can be included as follows (although each category carries sub-limits):

- Emergency, not lifesaving in or out of hospital (biliary and medical colic).

- Non-emergency in hospital (musculo-skeletal surgeries) or out of hospital (skin conditions).

- Parturition (foaling complications).

- Dispensed medication.

- Diagnostic imagery and endoscopy (gastroscopy, CT scan and x-rays).

- Lameness diagnosis, detection and treatment (musculo-skeletal lameness).

- Pathology, biopsy and haematology.

- Oral and maxillo-facial treatment (teeth extractions).

- Ophthalmology (enucleations).

- As an added benefit, a contribution to routine care is available e.g. vaccinations and deworming.

Who decides if the incident qualifies for a hospital claim?

The attending veterinarian is the only person certified to assess the situation and make that decision. They are bound by law to disclose the facts on the day of evaluation and treatment/surgery.

Public Liability Insurance

This product is specifically designed to cover an incident involving your insured horse and a third party. This third party cannot be a person or object that is commonplace in the horse’s environment, like the groom or farrier, or damage to your own horsebox. The claim would have to be related to a situation or person uninvolved with the insured horse, like a spectator or their car at a show-holding facility.

Pet Insurance

Arco360 also offers fantastic pet insurance products, which range from cover for hospital only to fully comprehensive cover. With the escalating veterinary costs, this is a must-have for your fur-kids, and with multiple-pet discount, is totally affordable!

Take-Home Message

Unless you can afford to carry your own risk, insurance is a must-have when owning anything of value. As the saying goes: ‘Don’t own anything you can’t afford to lose, but if you do, then insure it!’

Did you Know?

Our most common pet claim is gastrointestinal issues or dog bites!